Considering the day-to-day struggle people encounter, having to stand long hours on ATM queues to withdraw little money has become an exasperating exercise which drives them into the welcoming arms of POS business centres…

By John Augustina

POS business began to gain wide spread currency all around Africa so much so that an estimate in 2018 showed that South Africa, Nigeria and Egypt had 402,670, 116,868 and 59,200 active POS terminals respectively. This was caused by several factors, but it is owed particularly to the lockdown from the outbreak of COVID-19 when many banks were shut down temporarily. The demand for cash resulted in several POS stands cropping up in many parts of the continent, Nigeria especially.

Before the curtains fall on the tear-jerking experiences of each day, many are overwhelmed with exhaustion. It is no myth that whatever is done in Africa has its share of unease stemming from the complexities that are entrenched in the continent. People are poor, and are perpetually kept in a fix, where the only available option is to work under duress. It is also not newsy that Africa is associated with high levels of cash use, illiteracy, unfavourable working conditions, perpetual struggle for survival, constant demand for strenuous effort for success, negligence across different sectors of the economy, high rate of unemployment, etc.

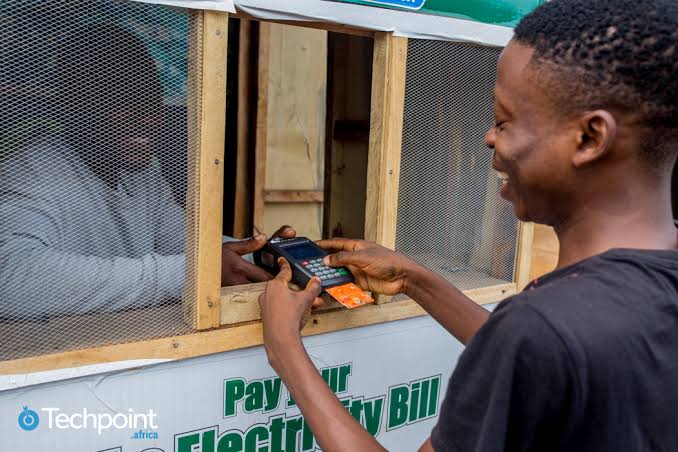

These complexities hold sway even in the financial institutions in Africa, specifically Nigeria. These complexities range from irregular network services to long queues and low cash deposits at ATM stands in banks, to poor customer relations skills in banks which makes it harder for people to gain access to their money. This, unarguably, led to the proliferation of Point of Sales (POS) terminals in 2013 following the introduction of the agent banking system by the Sanusi Lamido Sanusi-led Central Bank of Nigeria (CBN). The proliferation primarily serves the purpose of inclusion by extending services offered by financial institutions to relatively unreached, remote, unbanked, and underbanked parts of the country through third parties.

Since 2013 and moreso, since the break out of the coronavirus pandemic, Nigerians have largely embraced POS business. It has since become a lucrative business, and a great percentage of average Nigerians currently own POS centres. The POS business has become a good source of revenue for people who are already running businesses but are seeking extra profits, or for fresh and budding entrepreneurs who want to make some money by the side since starting and running the business does not include excessive overheads.

Indeed, there are many examples that underline just how transformative the agent banking system has been; from agency banking in East Africa empowering any certified merchant to offer banking services from their own store, to lottery tickets being sold to fund charity projects in the Ivory Coast, to the slightly more sobering sight of policemen collecting traffic fines on-the-go in Angola, to the different and many POS centres owned by many independent Nigerians.

Nigeria is undoubtedly the first country to truly understand the necessity of leveraging POS terminal services for purposes other than simple payments as the figure of POS units has significantly risen from 116,868 in 2018 to about 600,000 POS terminals in 2021. This led to businesses expanding and enriching their app portfolios, both to encourage more consumers to embrace the digital payment world and increase levels of trust in the technology as an alternative to cash. These innovations also created new ways for merchants to earn revenue, for example from lottery and banking services, to compensate for the acquisition cost of the terminal and the transaction fees.

Considering the day-to-day struggle people encounter, having to stand long hours on ATM queues to withdraw little money has become an exasperating exercise which drives them into the welcoming arms of POS centres which hold the assurance that the discomfort in banks can be avoided with the paying of a fair commission.

While the POS system has been beneficial in diverse ways such as in its convenience, product and service variety, as well as easy access to funds and speedy payment, it is plagued by such constraints as high cost of charges, insecurity over frauds through e-banking, and the issue of debit without credit. Other hazards associated with POS centres are unreliable network, power outage and security of communication over transaction networks. Still, the gains outweigh the losses.

The question, then, is: will this reform in the financial institution bring about the death of traditional banking system in Nigeria and other part of Africa? What, really, is the significance of traditional banking system or the unique service they offer that POS centres cannot give to customers? Many banks have lost customers to these third party agents and are yet to lose more in the nearest future.

A forecast projects that by 2026, the global POS terminal market value will be USD 116.27 billion against the USD 72.28 billion value in 2020. Another study showed an analysis from 2018 to 2026. The projection identified that there would be an increasing demand for POS terminals in retail industries, significant advancement and innovations in how best to offer better services to customers, as well as an increasing security concern regarding transactions.

These surveys and studies signal that POS terminals are fast replacing the traditional financial institutions in Africa. There is enough evidence to show that the fast-growing generation of millennials as well as a large number of the older generation will soon only patronise POS centres in place of traditional banking systems. The world is evolving, and people are taking a hard fight against the discomfort and bureaucracy that midwife modern traditional banking systems.

Today’s reality demands that real-time payments and banking capabilities should be available whenever and wherever they are needed by customers, a reality which from all indications is not possible due to the constant high demand from people. Africa and the world at large is undeniably going digital. New technologies, from social media to artificial intelligence and e-money, is revolutionising the financial space. These technologies are giving rise to new business models, with organisations using digitalised models to create and monetise new forms of value. Increasingly, this value is delivered through new cross-sector, outcome-based propositions, rather than traditional sector-specific products and services.

Africans are evolving, placing a demand on more speedy, convenient, technology-driven services. From many indications, it is evident that the next decade will herald a total transformation in the financial institutions and POS terminals will be at the centre of this change.

John Augustina is a 400 Level student of Mass Communication at the University of Benin.